CALGARY, Alberta, Aug. 14, 2024 (GLOBE NEWSWIRE) -- Burgundy Diamond Mines Limited (ASX:BDM) (Burgundy or the Company) is pleased to confirm that the agreement with the surety providers in relation to the reclamation bonds has been formally concluded and signed by all parties, in line with previously agreed principles (see ASX announcement dated March 13th, 2024).

Burgundy is required to post security with key government agencies to ensure reclamation is completed across its mining properties, as required by relevant legislation in Canada and the Northwest Territories. The security is provided in the form of either cash, letters of credit or surety bonds, or a combination of these.

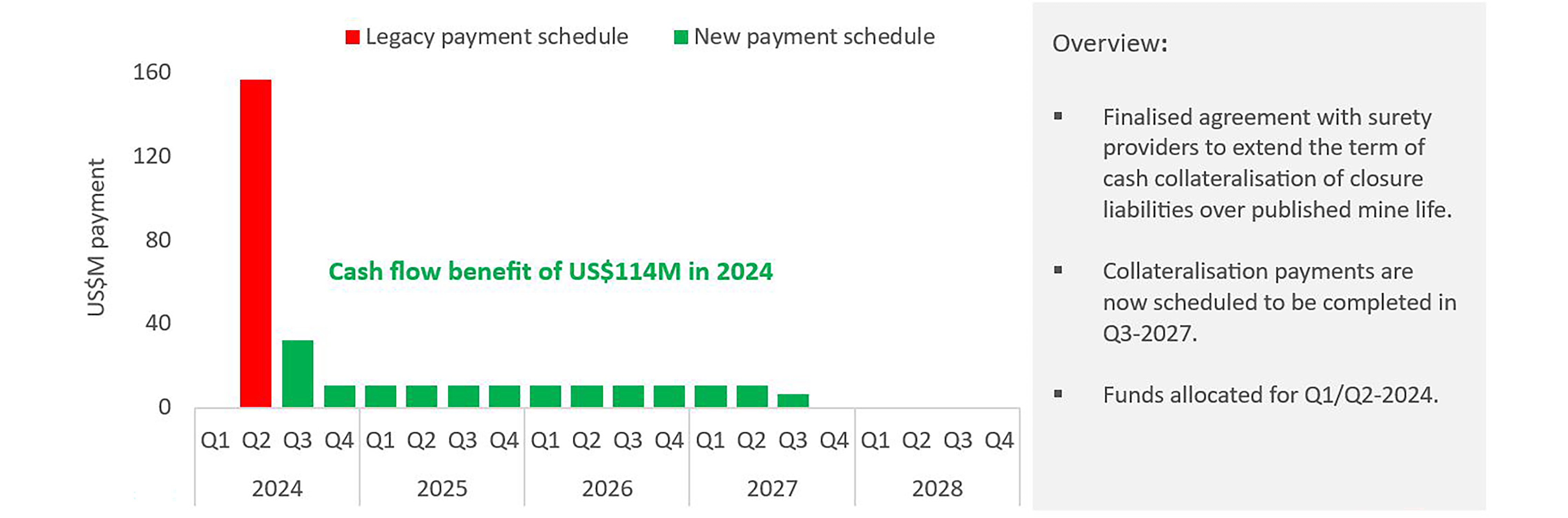

Significantly, Burgundy can confirm it has successfully concluded the renegotiated cash collateralisation payment schedule to extend over four years, consistent with Ekati’s current life of mine plan, versus the previous terms requiring full payment in Q2-2024. The revised cash collateralisation schedule1 provides for quarterly instalments of ~US$11 million, concluding with a final payment of ~US$7 million in Q3-2027 (see figure 1 below).

“This is a real game changer,” noted Kim Truter, CEO and Managing Director of Burgundy Diamond Mines. “Our revised long-term partnership and arrangement with our surety providers ensures our closure obligations are funded, releases cash to fund our mine extension options, and ensures we maintain a healthy cash reserve. Furthermore it reduces future financial liability related to reclamation requirements.”

“We remain increasingly optimistic regarding the attractiveness and optionality at Ekati, our cornerstone mining asset. With tier one infrastructure in place and a highly experienced operating team, the incremental capital cost and low execution risk of the mine life options are globally competitive. We also have significant exploration potential on or adjacent to our property.” said Truter.

Current conceptual mine life extension options include the extension of Misery underground, moving underground at Sable, developing an underground mine at Fox, processing high value Fox stockpiles, optimising the Point Lake project currently in the development stage, and implementing underwater remote mining technology, if trials are successful. Burgundy is committed to progressing work on the potential conceptual life of mine options in the most environmentally responsible and sustainable way, with support from regulators and local community stakeholders. The Company is anticipating formally publishing a new mine plan within the next 6 to 12 months.

Figure 1 – New payment schedule for reclamation surety bonds1

1. Rounded numbers, actual amounts vary. Q1-2024 and Q2-2024 payments have been allocated to Q3-2024. C$:US$ price conversion of 1.35 (as used in the ASX announcement dated 13 March 2024). This release does not include Point Lake reclamation payments as they are secured under a separate agreement.

This announcement was authorised for release by the Board of Burgundy Diamond Mines Limited.

Contacts

| Investor enquiries | Media enquiries | |

| investor@burgundydiamonds.com | communications@burgundydiamonds.com |

About Burgundy Diamond Mines Limited

Burgundy Diamond Mines is a premier independent global scale diamond company focused on capturing the end-to-end value of its unique vertically integrated business model.

Burgundy’s innovative strategy is focused on capturing margins along the full value chain of the diamond industry, including mining, production, cutting and polishing, and the sale of diamonds. By building a balanced portfolio of diamond projects in favourable jurisdictions, including the globally ranked Canadian mining asset, Ekati, and a diamond cutting and polishing facility in Perth, Burgundy has unlocked access to the full diamond value chain. This end-to-end business model with total chain of custody provides traceability along every step of the process, with Burgundy able to safeguard the ethical production of the diamonds from mining to marketing and discovery to design. Burgundy was founded in Perth, Western Australia. The company is led by a world-class management team and Board.

Caution regarding Forward Looking Information

This document contains forward looking statements concerning Burgundy Diamond Mines Limited. Forward looking statements are not statements of historical fact and actual events and results may differ materially from those described in the forward-looking statements as a result of a variety of risks, uncertainties and other factors. Forward looking statements in this document are based on Burgundy's beliefs, opinions and estimates as of the dates the forward-looking statements are made, and no obligation is assumed to update forward looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a5446387-1c01-43b2-8763-7d39f2a59cb2

source: Burgundy Diamond Mines

【你點睇?】皇馬巴塞傳奇表演賽爆簽名會風波,26人買涉$20萬套票僅見部份球星15分鐘,你認為事件哪方須負較大責任?► 立即投票