|

SINGAPORE, Oct. 2, 2024 /PRNewswire/ -- Singapore-based fintech ROSHI has released an extensive report analysing the future of digital lending, focusing on global trends expected to shape the industry in 2025 and beyond. The report provides in-depth insights into the transformative impact of technology on the financial sector particularly in lending practices.

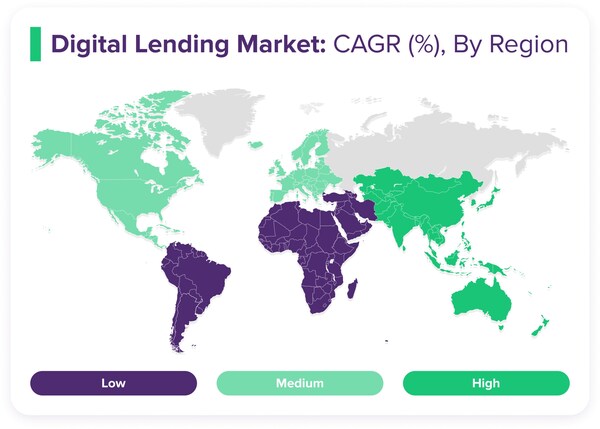

The report reveals significant growth projections across various sectors of digital lending. AI-powered lending models are enhancing credit risk assessment, potentially improving performance by 10-15% compared to traditional models. The global peer-to-peer lending market is expected to experience substantial expansion, with projections indicating it will surpass US$705.81 billion by 2030, growing at a CAGR of 26.7% from 2022 to 2030.

Decentralised Finance (DeFi) emerges as a major trend with the market valued at USD 13.61 billion in 2022 and expected to expand at a CAGR of 46.0% from 2023 to 2030. The report also highlights the growing influence of open banking, noting that by January 2024, 13% of digitally active consumers in key European markets were using open banking services.

Overall, the digital lending platforms market is set for significant growth with projections indicating it will reach a valuation of USD 795.34 billion by 2029, growing at a CAGR of 11.90%.

"Our analysis reveals that the lending landscape is undergoing a profound transformation driven by AI, blockchain and open banking technologies," stated Amir Nada, ROSHI Founder and CEO. "While these advancements offer unprecedented opportunities for both lenders and borrowers they also present new challenges in terms of regulation and data security."

The report also explores the rise of green loans, the impact of personalization on lending practices and the regulatory challenges facing the industry. This comprehensive view aims to provide valuable insights for financial institutions, policymakers and consumers alike.

ROSHI continues its mission to offer transparent, data-driven insights to help stakeholders navigate the complex and rapidly changing landscape of digital lending. The full report can be accessed here.

ROSHI is a Singapore-based fintech transforming digital lending across Southeast Asia. Since its launch in March 2022, the fintech has leveraged AI algorithms and machine learning to assist borrowers with their lending requirements. Through partnerships with various banks and lenders the platform has helped hundreds of individuals secure approvals.

Contact Information

Amir Nada

ROSHI Pte Ltd

Singapore, SG

Voice: +65 8950 9286

E-Mail: media@roshi.sg

Website: https://www.roshi.sg/

source: ROSHI

《說說心理話》心理急救II:幾個徵兆辨認身邊人需要心理支援!點樣對情緒進行急救、自我照顧?專家分享穩定情緒小練習► 即睇